What Tax Forms Do Independent Contractors Need . this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. there are three independent contractor tax forms that businesses must file to avoid penalties. Learn about what tax forms to give contractors from paychex. But they accomplish different things. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure.

from www.editableforms.com

there are three independent contractor tax forms that businesses must file to avoid penalties. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. Learn about what tax forms to give contractors from paychex. But they accomplish different things.

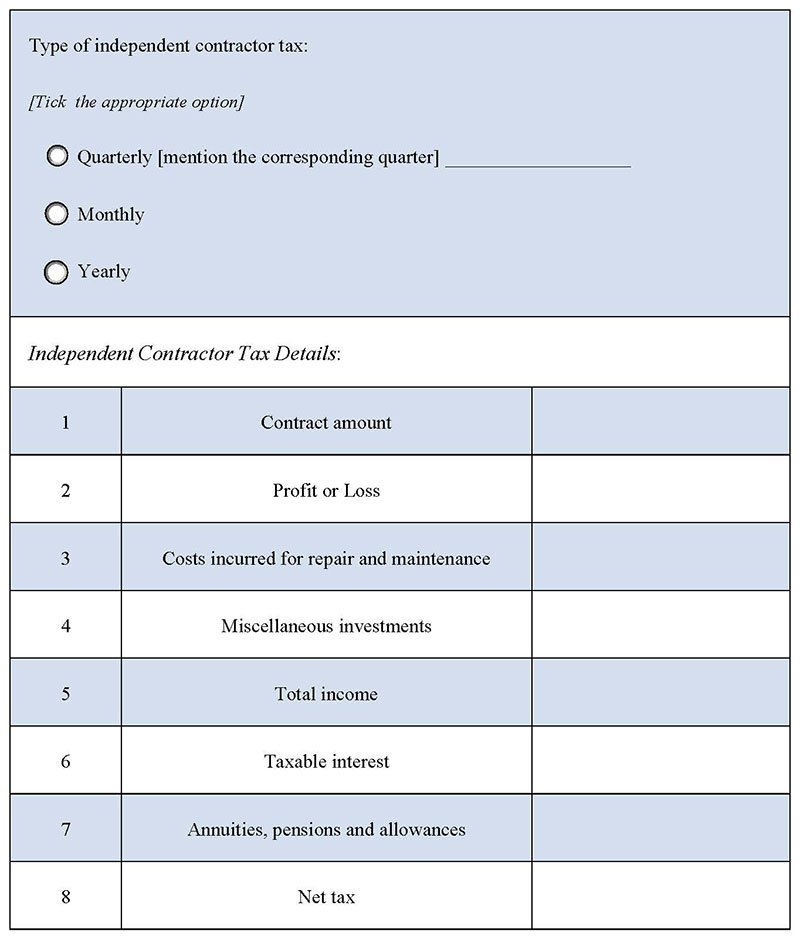

Independent Contractor Tax Form Editable PDF Forms

What Tax Forms Do Independent Contractors Need you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. Learn about what tax forms to give contractors from paychex. But they accomplish different things. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. there are three independent contractor tax forms that businesses must file to avoid penalties. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure.

From www.sampleforms.com

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel What Tax Forms Do Independent Contractors Need there are three independent contractor tax forms that businesses must file to avoid penalties. Learn about what tax forms to give contractors from paychex. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. To file taxes correctly, you need to track down. What Tax Forms Do Independent Contractors Need.

From www.skuad.io

A Complete List of Forms for Independent Contractors Skuad What Tax Forms Do Independent Contractors Need if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. there are three independent contractor. What Tax Forms Do Independent Contractors Need.

From taxproblemsolver.com

What Independent Contractors Need to Know About Taxes Tax Problem Solver What Tax Forms Do Independent Contractors Need Learn about what tax forms to give contractors from paychex. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. you could be considered an. What Tax Forms Do Independent Contractors Need.

From www.pdffiller.com

Do Independent Contractors Need Tax ID Numbers? Doc Template pdfFiller What Tax Forms Do Independent Contractors Need But they accomplish different things. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. you could be considered an independent contractor if you operate as a sole proprietor,. What Tax Forms Do Independent Contractors Need.

From www.sampleforms.com

FREE 9+ Sample Independent Contractor Forms in MS Word PDF Excel What Tax Forms Do Independent Contractors Need if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. there are three independent contractor tax forms that businesses must file to avoid penalties. Learn. What Tax Forms Do Independent Contractors Need.

From www.typecalendar.com

Free Printable Independent Contractor Agreement Templates [Word, PDF] What Tax Forms Do Independent Contractors Need this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. if you run your business part time, and you’re also someone’s employee, you’ll need to file your. What Tax Forms Do Independent Contractors Need.

From clockify.me

A guide to independent contractor taxes — Clockify™ What Tax Forms Do Independent Contractors Need you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. But they accomplish different things. Learn about what tax forms. What Tax Forms Do Independent Contractors Need.

From templatelab.com

50+ FREE Independent Contractor Agreement Forms & Templates What Tax Forms Do Independent Contractors Need this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. To file taxes correctly, you need to track down 1099 forms from businesses you worked with. What Tax Forms Do Independent Contractors Need.

From templatelab.com

50+ FREE Independent Contractor Agreement Forms & Templates What Tax Forms Do Independent Contractors Need Learn about what tax forms to give contractors from paychex. But they accomplish different things. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. To file taxes. What Tax Forms Do Independent Contractors Need.

From www.slideserve.com

PPT Do Independent Contractors Need to Pay Taxes? PowerPoint What Tax Forms Do Independent Contractors Need you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. But they accomplish different things. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. if you run your business part time, and you’re also someone’s employee,. What Tax Forms Do Independent Contractors Need.

From cecthbpp.blob.core.windows.net

What 1099 Form Is Used For Independent Contractors at Calvin Haugen blog What Tax Forms Do Independent Contractors Need if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. there are three independent contractor tax forms that businesses must file to avoid penalties. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last. What Tax Forms Do Independent Contractors Need.

From www.gkaplancpa.com

The Independent Contractor Tax Form Your Guide to the 1099 What Tax Forms Do Independent Contractors Need To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. there are three independent contractor tax forms that businesses must file to avoid penalties. Learn about what tax forms. What Tax Forms Do Independent Contractors Need.

From www.everlance.com

How to File Taxes as an Independent Contractor Everlance What Tax Forms Do Independent Contractors Need But they accomplish different things. there are three independent contractor tax forms that businesses must file to avoid penalties. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a. What Tax Forms Do Independent Contractors Need.

From intuit-payroll.org

Tax Guide For Independent Contractors What Tax Forms Do Independent Contractors Need you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. there are three independent contractor tax forms that businesses must file to avoid penalties. But they accomplish different things. this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how. What Tax Forms Do Independent Contractors Need.

From templatelab.com

50+ FREE Independent Contractor Agreement Forms & Templates What Tax Forms Do Independent Contractors Need this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. there are three independent contractor tax forms that businesses must file to avoid penalties. Learn about what tax forms. What Tax Forms Do Independent Contractors Need.

From printableformsfree.com

Printable Independent Contractor 1099 Form Printable Forms Free Online What Tax Forms Do Independent Contractors Need there are three independent contractor tax forms that businesses must file to avoid penalties. Learn about what tax forms to give contractors from paychex. To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. But they accomplish different things. if you run your business. What Tax Forms Do Independent Contractors Need.

From www.uslegalforms.com

Independent Contractor Application Pdf 2020 Fill and Sign Printable What Tax Forms Do Independent Contractors Need this handy guide for independent contractors explains tax responsibilities, deadlines, deductions and how to pay. if you run your business part time, and you’re also someone’s employee, you’ll need to file your own business taxes with form 1040 (us individual income tax. you could be considered an independent contractor if you operate as a sole proprietor, form. What Tax Forms Do Independent Contractors Need.

From www.hellobonsai.com

6 mustknow basics form 1099MISC for independent contractors Bonsai What Tax Forms Do Independent Contractors Need To file taxes correctly, you need to track down 1099 forms from businesses you worked with last year that paid you more than $600. you could be considered an independent contractor if you operate as a sole proprietor, form a limited liability company (llc) or adopt a corporate structure. there are three independent contractor tax forms that businesses. What Tax Forms Do Independent Contractors Need.